About

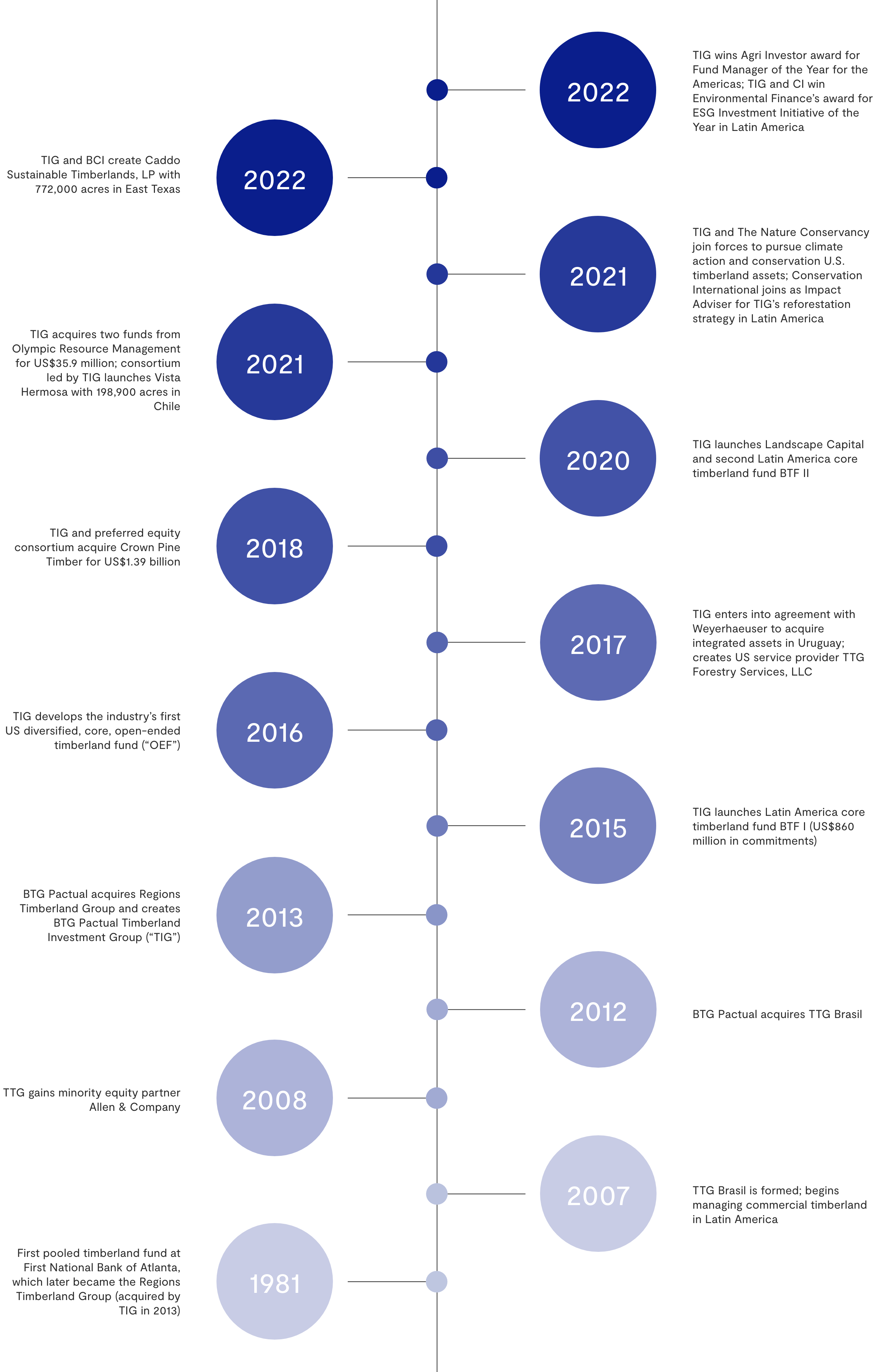

The Timberland Investment Group is one of the world’s largest timberland managers.

We have US$ 7.5 billion assets and commitments and 3.0 million acres under management throughout the U.S. and Latin America. [1] Since its inception, more than US$ 3.3 billion has been returned to investors. [2]

Our team of ~160 professional staff has an on-the-ground presence through 23 offices around the globe, bringing local, regional, and global experience to bear on the management of client investments. [3]